Why Logan County Property Tax Search by Address is Essential

Property taxes are a critical responsibility for homeowners in Logan County. Knowing exactly how much you owe and when it’s due prevents late fees and financial complications. Using the Logan County Property Tax Search by Address ensures you receive accurate tax information directly from the county database. It is particularly important if multiple properties share similar owner names or street addresses. This property search tool provides transparency, showing past payments, parcel numbers, and current dues. Accurate tax information reduces stress, saves time, and allows homeowners to plan their finances confidently. Official searches help avoid misinformation from third-party sources.

How to Perform a Logan County Property Tax Search by Address

Searching property taxes in Logan County is straightforward if you follow the official procedure. Start by visiting the Logan County Auditor’s website, where the property search tool is available. Enter the property address correctly, including street number, name, and unit if applicable. Once submitted, the system displays the property’s tax details, including amounts owed, due dates, and historical payment records. You can review, download, or print the information for your files. The Logan County Property Tax Search by Address process ensures accuracy, saving homeowners from costly mistakes and providing a clear view of their property tax obligations.

Step 1 – Access the Official Property Search Tool

Navigate to the Logan County Auditor’s official website and locate the property search by address tool. This tool is specifically designed for accurate and official property tax lookup. Avoid third-party websites, as they may provide outdated or incorrect data. The page includes fields for entering the street number, street name, and optional unit or apartment. Using the official portal ensures the information you retrieve is trustworthy and complete.

Step 2 – Enter Property Address Accurately

Type the property address carefully. Accuracy is key, especially for properties with similar names or numbers. Include apartment or unit numbers if applicable. The Logan County Property Tax Search by Address tool matches the input against official records, ensuring you access the correct property tax data. Double-checking spelling can prevent errors or mismatched records.

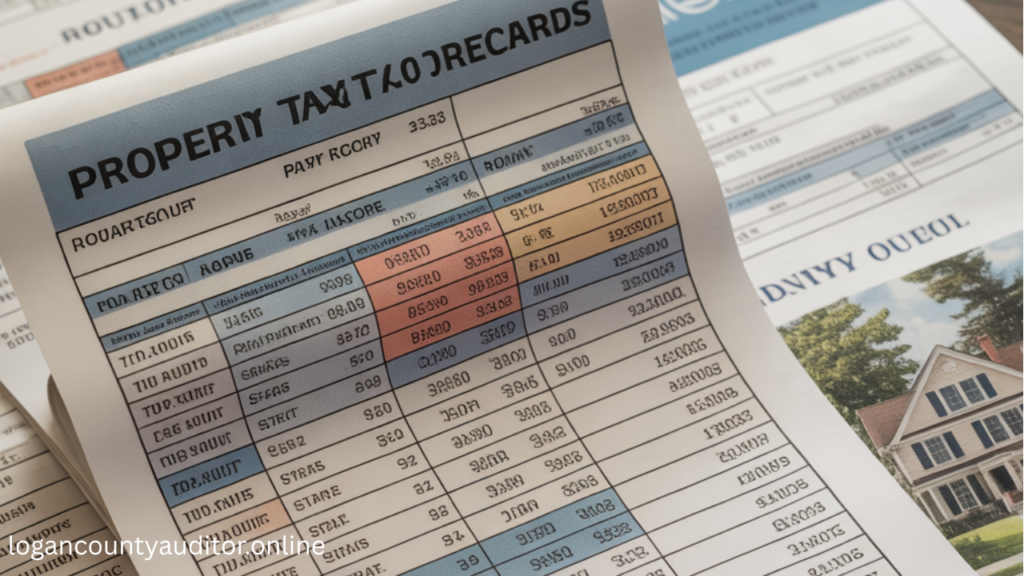

Step 3 – Review Property Tax Details

Once the address is submitted, a summary appears showing taxes owed, due dates, past payments, and parcel information. Tables clearly organize yearly tax amounts, penalties, and totals. Review each field carefully to confirm details. Understanding this table allows homeowners to plan payments effectively and avoid unexpected fees.

Step 4 – Download or Print Records

For personal or legal purposes, you can download or print the property tax records. Maintaining physical or digital copies is useful for financial planning, property sales, or proof of payment. The property search tool ensures records are accurate, official, and up-to-date.

Tips to Ensure Accurate Property Searches

To avoid errors while using the Logan County Property Tax Search by Address tool:

- Double-check the property address spelling.

- Use the official auditor website only.

- Bookmark the property search page for easy access.

- Verify multiple properties separately if you own more than one.

- Review historical records to confirm consistency.

Following these steps ensures accuracy, avoids stress, and helps you manage property taxes effectively. Using official property search tools maintains peace of mind and financial control.

Common Issues and How to Solve Them

Address Not Found

If the property address does not appear, verify the spelling and format. Older properties may have updated addresses. Contact the Logan County Auditor for assistance.

Incorrect Tax Information

In rare cases, the tax amount displayed may be inaccurate. Contact the Auditor’s office directly to resolve discrepancies. Always use official tools to avoid third-party errors.

Related Searches and Semantic Keywords

Including related searches improves content relevance and SEO. Examples include:

- Logan County property tax lookup by owner

- Parcel number property search

- Historical property tax records

- Real estate property tax search Logan County

Integrating these semantic keywords naturally within your article strengthens authority and relevance for Google’s NLP analysisH4: Optional Table – Sample Property Tax Record

| Year | Taxes Owed | Penalty | Total Paid |

|---|---|---|---|

| 2026 | $2,500 | $0 | $2,500 |

| 2025 | $2,400 | $50 | $2,450 |

| 2024 | $2,300 | $0 | $2,300 |

FAQs

- How do I search Logan County property taxes by address?

Use the official auditor tool and enter your full property address. - Can I pay taxes online after searching by address?

Yes, the auditor’s website provides direct payment links. - What if my property address isn’t listed?

Double-check spelling or contact the Logan County Auditor. - Is there a fee to use the property search tool?

No, it is free and official. - Can I view historical tax records?

Yes, past payments and parcel history are displayed. - How often are property tax records updated?

Records are regularly updated to reflect current taxes and payments. - What details are shown in the property search?

Taxes owed, due dates, parcel number, and historical records. - Can I print property tax records for official use?

Yes, downloadable and printable options are available. - Who do I contact if I see errors in the records?

Contact the Logan County Auditor office via phone or email. - Can I search multiple properties at once?

Each property must be searched individually using its address.

Conclusion

The Logan County Property Tax Search by Address tool is essential for homeowners seeking accurate tax information. By following the step-by-step guide, you can view property taxes, historical payments, and parcel details confidently. Using official tools reduces mistakes, prevents penalties, and saves time. Keep records downloaded or printed for personal reference. Whether you are a first-time property buyer or a longtime resident, performing a property search by address ensures transparency, financial planning, and peace of mind. Always rely on official county tools to maintain accuracy and compliance.